This is the first in what we plan as a series of posts on what the Administration and Congress may do to address the nation’s ailing infrastructure.

Earlier this week, a list of priority infrastructure projects of the Trump administration surfaced on the Internet.

While the authenticity of the list is unclear, the National Governor’s Association, which published the list, claimed that over the last few months, the Trump transition team had sought input from governors as the administration was formulating a national infrastructure policy. According to the Association, each governor was asked to suggest 3-5 projects in their states that met specific criteria established by the administration. These include:

(a) A national security or public safety “emergency”

(b) “Shovel-ready”, with at least 30 percent of initial design and engineering work complete

(c) Direct job creator

(d) Potential for increased U.S. manufacturing

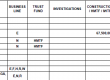

It contains a condensed list of 50 infrastructure projects nationwide that were vetted as priority projects by the Trump administration. They range from airports and highways to railways and ports. The total cost of all projects for FY17 is around $137.5 billion.

There will doubtlessly be considerable discussion about which projects made the cut and which did not, and what those selections may suggest about Trump’s priorities. This is of course a very important discussion to be had. But what is not said is how the Trump administration plans to pay for a national infrastructure program.

An article in McClatchyDC analyzing the priority list offers a clue about Trump’s financing plans. In the matrix of projects, the last column, after “Project”, “Sector”, and “State”, is “Revenue Stream” with either a Y or N given for each project. Since revenue stream was included as a metric of concern, there is reason to believe that private money may play a critical role in funding America’s infrastructure under Trump. In fact, during the campaign, Trump stated that he would give tax credits to private investors who are willing to invest in infrastructure like toll roads, toll bridges, and other projects that generate their own revenue. According to Trump, these tax breaks could generate $1 trillion worth of projects, at a fraction of the cost to the federal exchequer.

If heavy reliance on private money is how Trump plans to fund infrastructure, then the path to the revitalization of the nation’s infrastructure is going to be a long one that’s fraught with large potholes and strong waves. The private sector understandably wants to maximize profits and minimize risks from any investment in public infrastructure. The purported Trump list of possible priority projects notation of which ones have a revenue stream is only one step. For example, an inland lock system has a revenue stream in the form of an Inland Waterways Trust Fund. The same goes for ports and the Harbor Maintenance Trust Fund. Will these taxes have to be raised to provide the necessary profits? Is there a national security issue in turning over key water resources to private interests in a global economy where determining ownership is often tricky? And I haven’t even touched on negotiating a satisfactory contractual arrangement that provides the public, at a minimum, with a level of transparency and compensation for what is being transferred to private hands. Theoretically, none of these issues is a deal-killer, but they will take time to work through. For those infrastructures projects that don’t have a revenue stream that can be made part of a deal with a private investor, the only choice is neglect or use government revenues.

Stay tuned for more developments over the next several days. For now, however, the infrastructure program will rely less on “shovel-ready” and more on “private profit-ready" projects.